There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Discover Your Trading Edge Using Market Profile and Order flow

Language: English

Instructor: By FEBINARS Team

Date : 13 - Nov 2021

Time : 10.00 AM to 04.30 PM

Offline Payment Details:

Bank: Equitas Small Finance Bank Ltd

Account No: 200001351550

Branch : Thillainagar

IFSC : ESFB0001017

| Market Profile Basics Part I - 10:00 AM IST 13 - Nov - 2021 (149:00) | |||

| Market Profile Basics Part II - 2:00 PM IST 13 - Nov - 2021 (126:00) | |||

| Point of Control Based Strategies - Part I - 10:00 AM IST 14 - Nov - 2021 (124:00) | |||

| Point of Control Based Strategies - Part II - 2:00 PM IST 14 - Nov - 2021 (109:00) | |||

| Orderflow - Part 1 - 10:00 AM IST 20 - Nov - 2021 (121:00) | |||

| Orderflow - Part 2 - 2:00 PM IST 20 - Nov - 2021 (113:00) | |||

| Orderflow - Part 3 - 10:15 AM IST 21 - Nov - 2021 (101:00) | |||

| Orderflow - Part 4 - 2:00 PM IST 21 - Nov - 2021 (136:00) | |||

| Recording - Live Morning Session - 10:15 AM IST 04 - Dec - 2021 (94:00) | |||

| Recording - Live Afternoon Session - 2:00 PM IST 04 - Dec - 2021 (134:00) | |||

| Recording - Live Morning Session - 10:00 AM IST 05 - Dec - 2021 (123:00) | |||

| Recording - Live Afternoon Session - 2:00 PM IST 05 - Dec - 2021 (123:00) | |||

| Recording - Live Morning Session - 10:00 AM IST 11 - Dec - 2021 (140:00) | |||

| Live Morning Session - 10:15 AM IST 27 - Nov - 2021 | |||

| Live Afternoon Session - 2:00 PM IST 27 - Nov - 2021 | |||

| Live Morning Session - 10:15 AM IST 04 - Dec - 2021 | |||

| Live Afternoon Session - 2:00 PM IST 04 - Dec - 2021 | |||

| Live Morning Session - 10:00 AM IST 05 - Dec - 2021 | |||

| Live Afternoon Session - 2:00 PM IST 05 - Dec - 2021 | |||

| Live Morning Session - 10:00 AM IST 11 - Dec - 2021 | |||

| Live Afternoon Session - 2:00 PM IST 11 - Dec - 2021 | |||

After successful purchase, this item would be added to your courses.You can access your courses in the following ways :

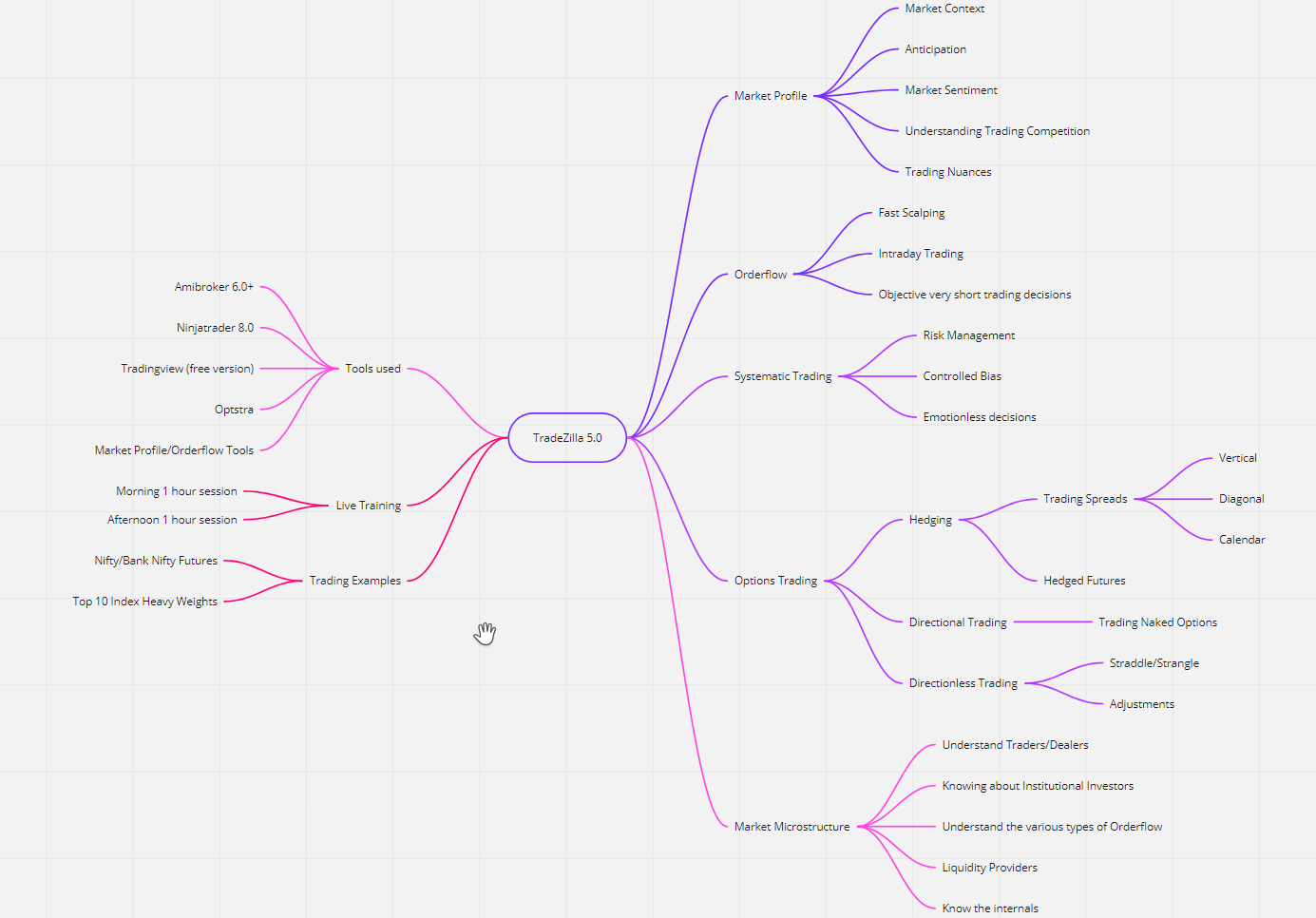

Tradezilla 5.0 is an online mentorship event focused on short-term / intraday trading primarily for wanna-be full-time derivative traders. Tradezilla 5.0 focuses on concepts like Market Profile, Orderflow, Options Trading, hedged strategies,

system trading, market microstructure. It is an institutional grade technical analysis program that uses an adaptive hybrid approach (Systematic + Discretionary) concept to read the markets to trade in any market conditions.

The analysis provided is in-depth and requires repeated practice to get the screen Time experience. Hence a 3 month of training exercise could provide traders to learn the adaptive approach.

You can consider using our private trading community in slack + one can also continue the daily live training session by enrolling in Traderscafe.

Traderscafe is an online hangout place for traders who want to increase their screen Time expertise along with us. Tradescafe comes as a 3 month of complimentary subscription along with Tradezilla 5.0 Mentorship course.

Traders will be learning mostly the principles of Market Profile, Orderflow, Trading Systems, Trading Psychology, Market Sentiment..

At this point, we focus only on Nifty, Bank Nifty Futures, and Top 10 heavyweight stocks.

Absolutely, However, ensure that you have basic knowledge of Futures and Options concepts.

The trading principles that we are teaching fit most of the high liquid counters. However live sessions and examples will be mostly from the derivative segments (Futures and Options)

Not at this point. However the concepts that we teach is applied to all the asset classes

For practice, purpose traders should come up with Amibroker, Ninjatrader tools which are free to download. Occasionally we also use Tradingview/Opstra tools (Free Plans)

For practice purpose it is highly recommended to use Windows as Amibroker/Ninjatrader is built to work only in windows environment.

Yes. 80% of the course covers Market Profile/Orderflow concepts.

Yes. 80% of the course covers Market Profile/Orderflow concepts.

Yes we do.

Absolutely not. We provide actionable insights from a short term trading/intraday trading, Objective framework, teach traders to monitor trading conditions, help traders to identify good trade locations and more than that we help traders to improve their learning curve towards a sustainable trading environment.

It is highly recommended traders listen to the concepts. As the concepts are intensive more focused attention and deliberate focus is required to achieve a faster screentime experience. Traders who trade during an education session have a terrible trading performance.